DeFi Earning

DeFi Earning

DeFi Earning

Made Simple

Made Simple

Made Simple

Set it and forget it. AI-Powered automated DeFi strategies deliver peak returns with zero manual management required. Everything you need to earn.

Set it and forget it. Automated DeFi strategies deliver peak returns with zero manual management required. Everything you need to earn.

Available on

Available on

+14

+14

Multiple earning strategies

Multiple earning strategies

Multiple earning strategies

AI liquidity engine that reallocates your assets across chains for real yield. Securely and transparently.

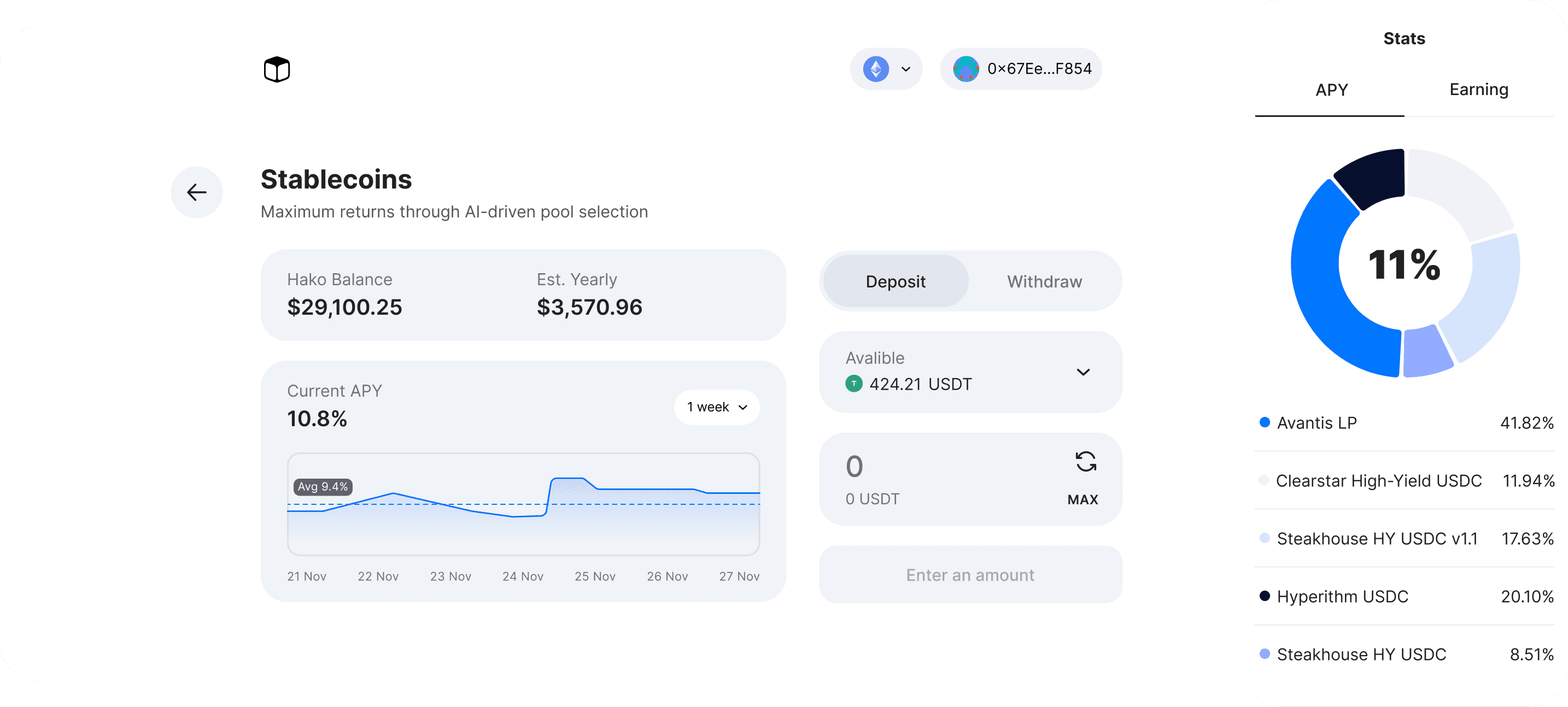

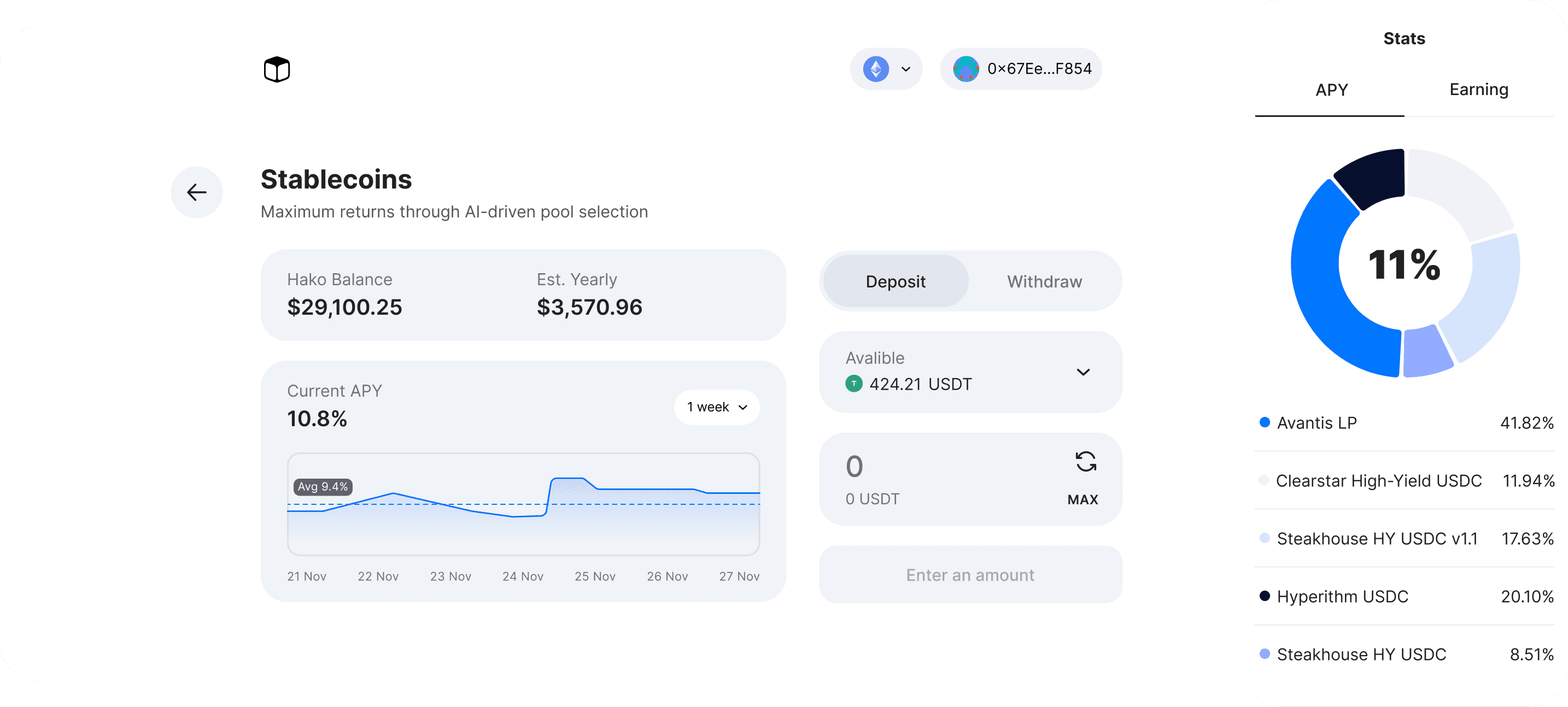

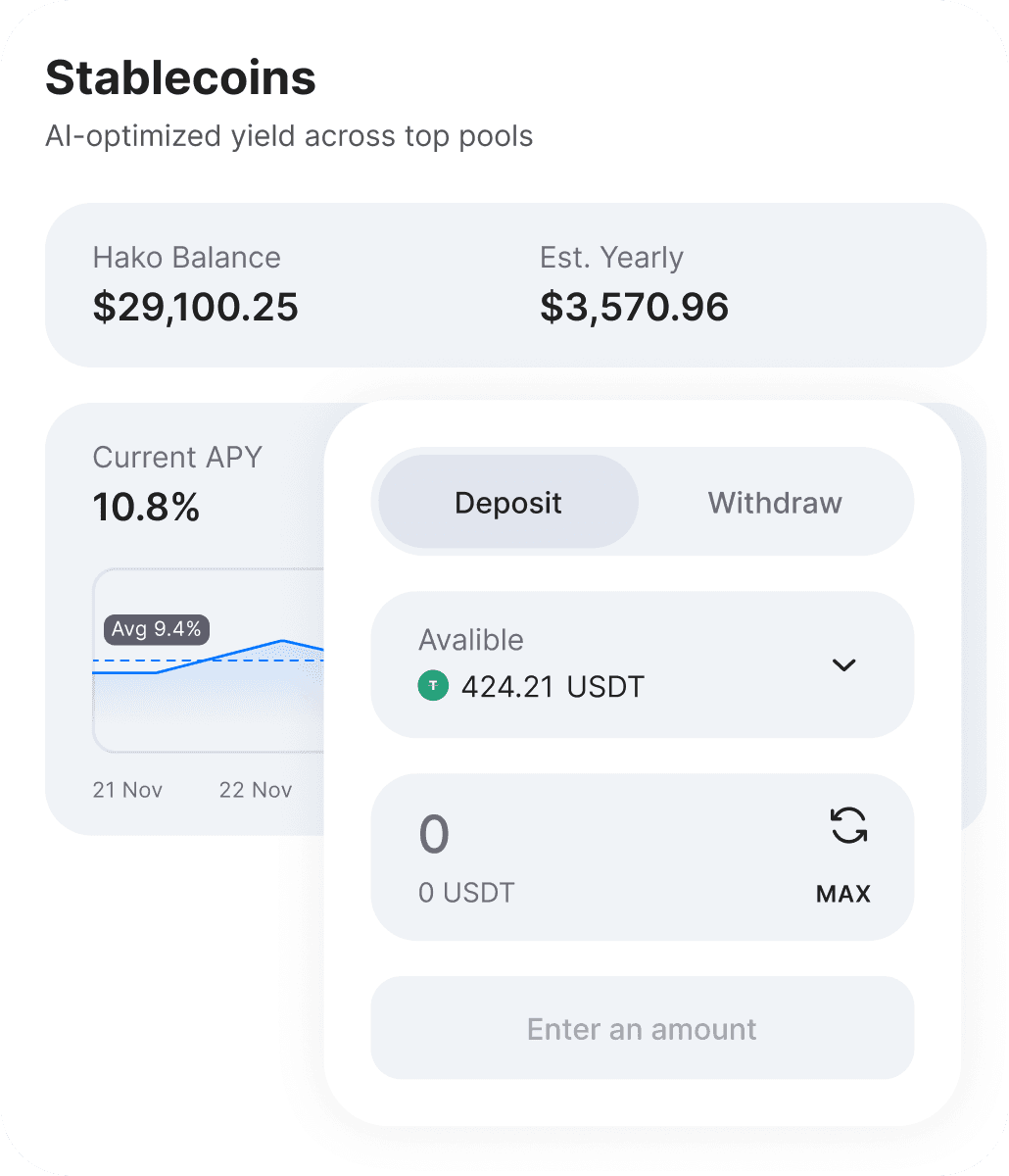

Stablecoins

ETH

AMM Pools

Stable Yield Strategy

Up to 14% APR

Stable Yield Strategy Up to 14% APR

Stable Yield Strategy

Up to 14% APR

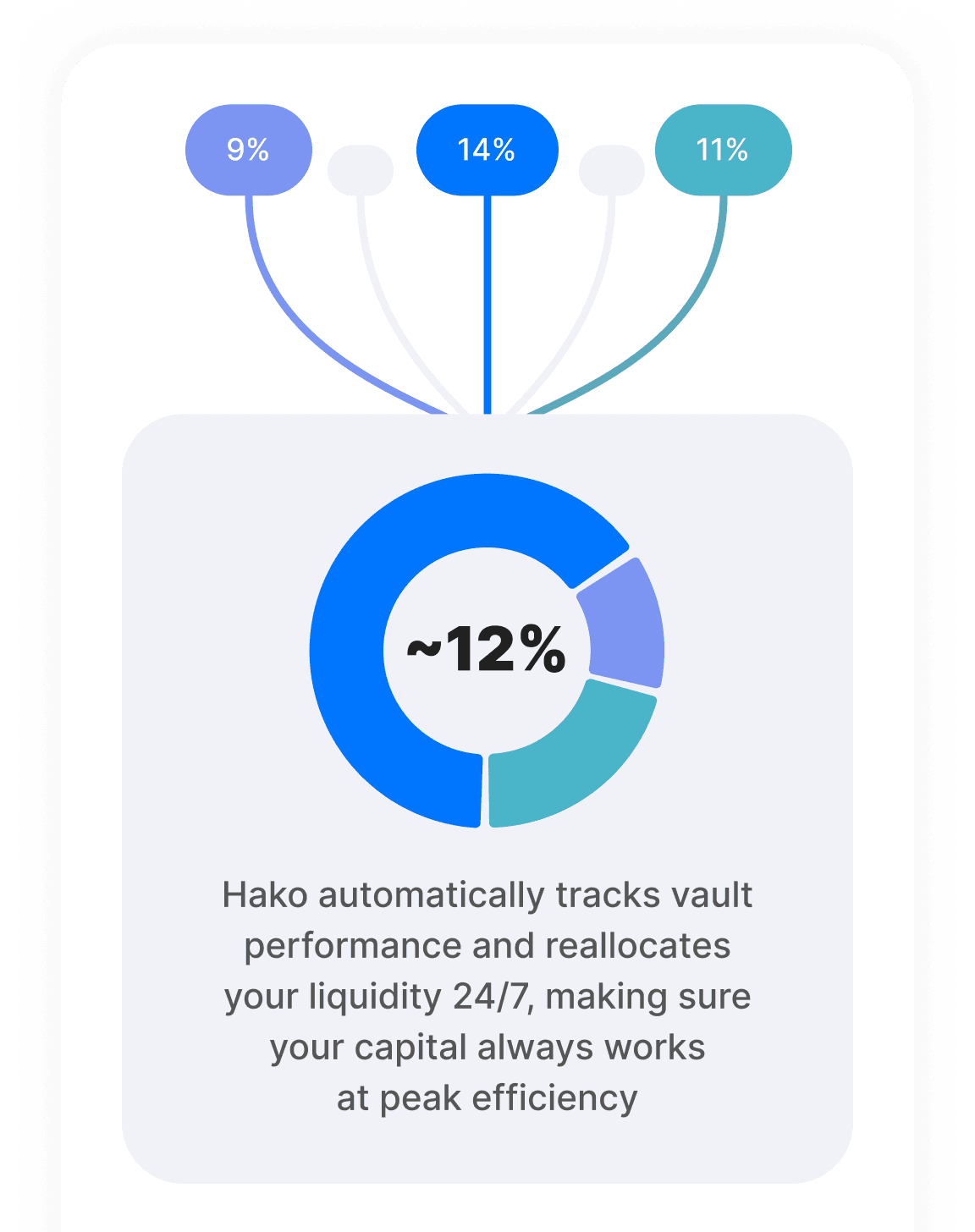

Hako’s Stable Yield uses only the most trusted stables: USDT, USDC, and DAI, and automatically reallocates funds to the highest-earning pools. Your funds stay at peak performance 24/7, with zero effort from you.

Hako’s Stable Yield uses only the most trusted stables: USDT, USDC, and DAI, and automatically reallocates funds to the highest-earning pools. Your funds stay at peak performance 24/7, with zero effort from you.

Hako’s Stable Yield uses only the most trusted stables: USDT, USDC, and DAI, and automatically reallocates funds to the highest-earning pools. Your funds stay at peak performance 24/7, with zero effort from you.

Join Waitlist

How it works?

How it works?

How it works?

Trusted Partners

and Verified Vault Providers

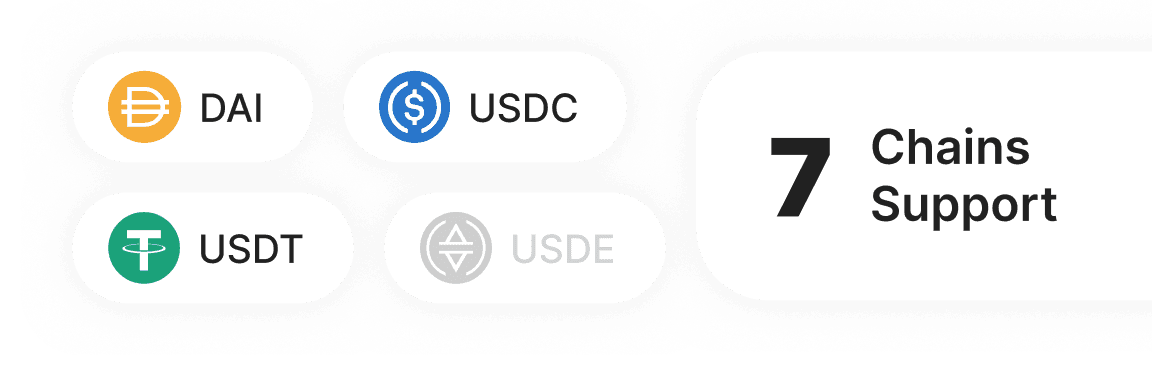

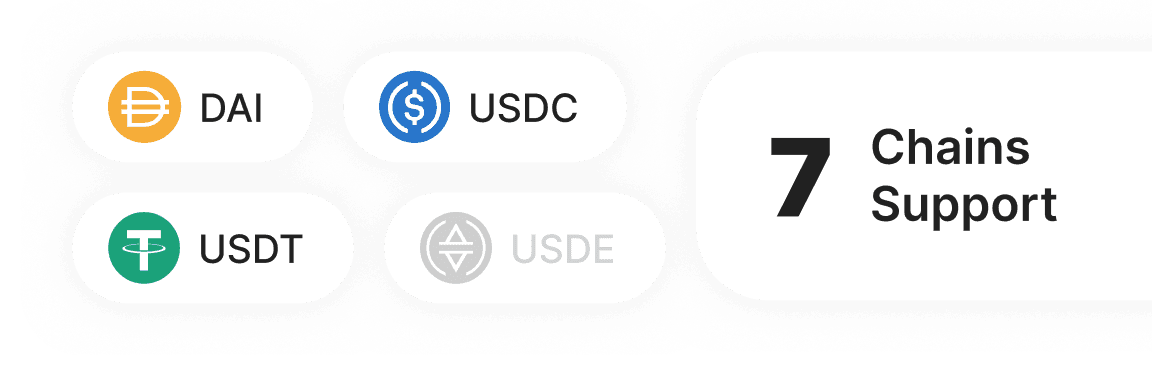

Cross-Chain Deposits

& Supported Networks

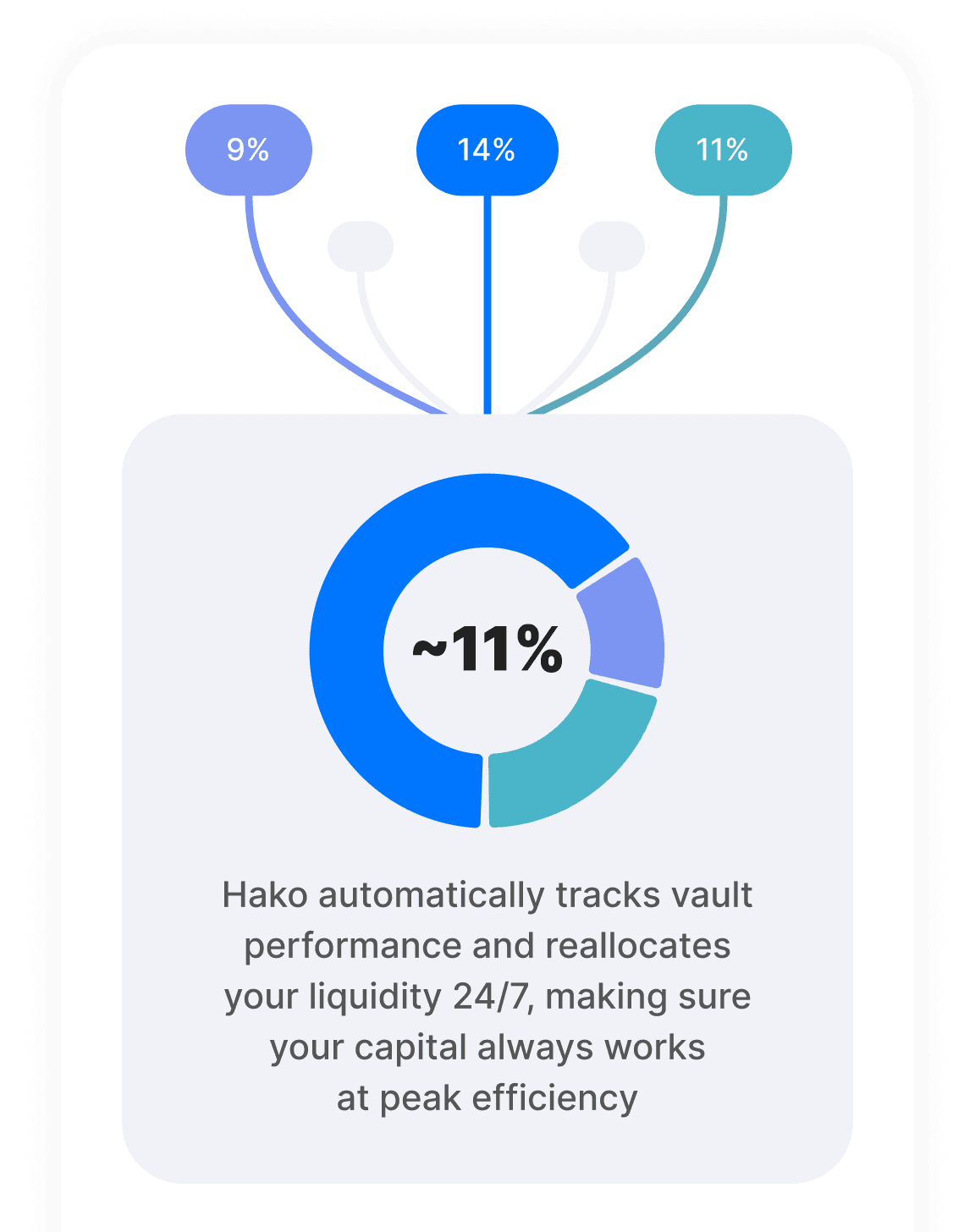

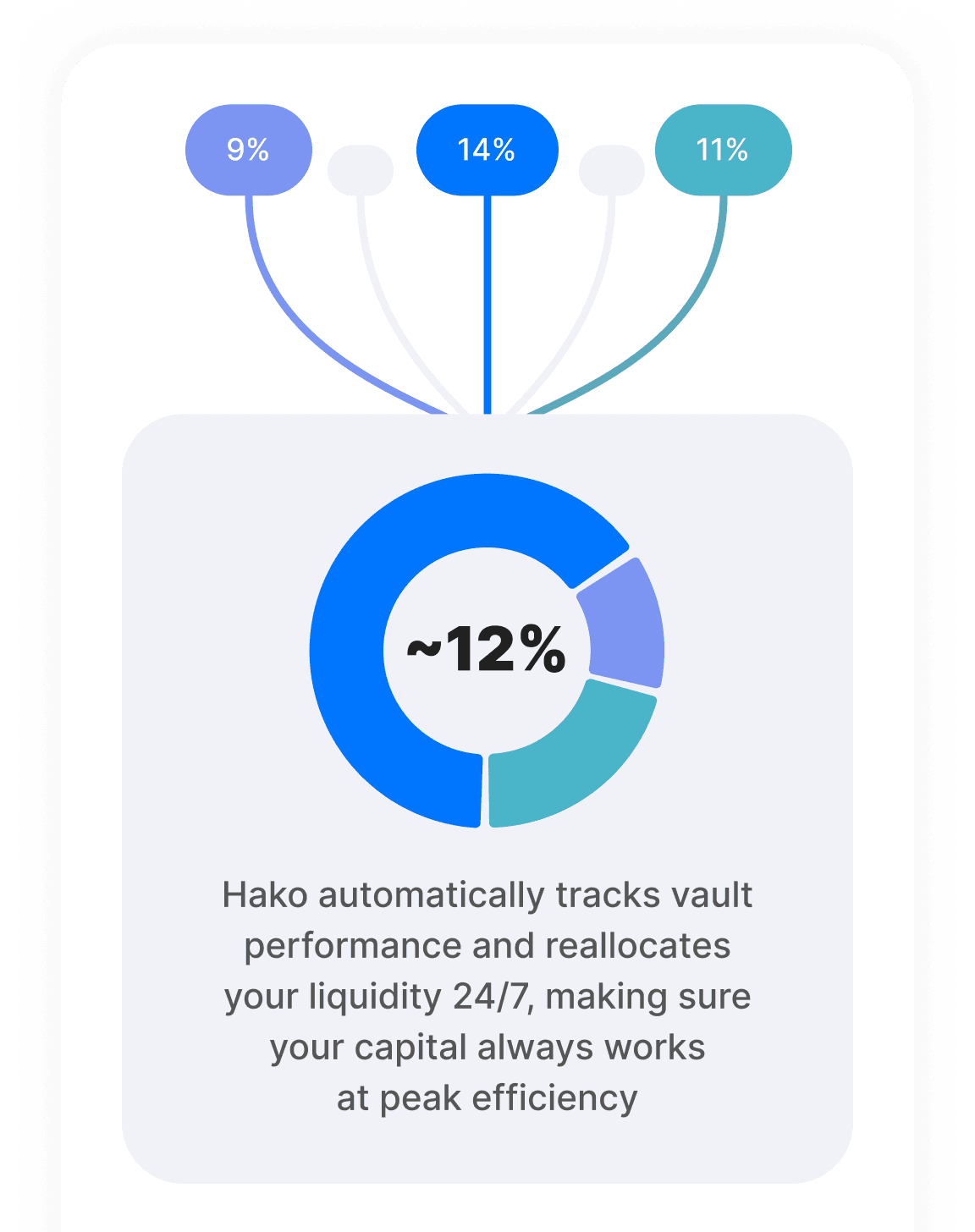

How the Strategy Operates & Allocates Your Liquidity

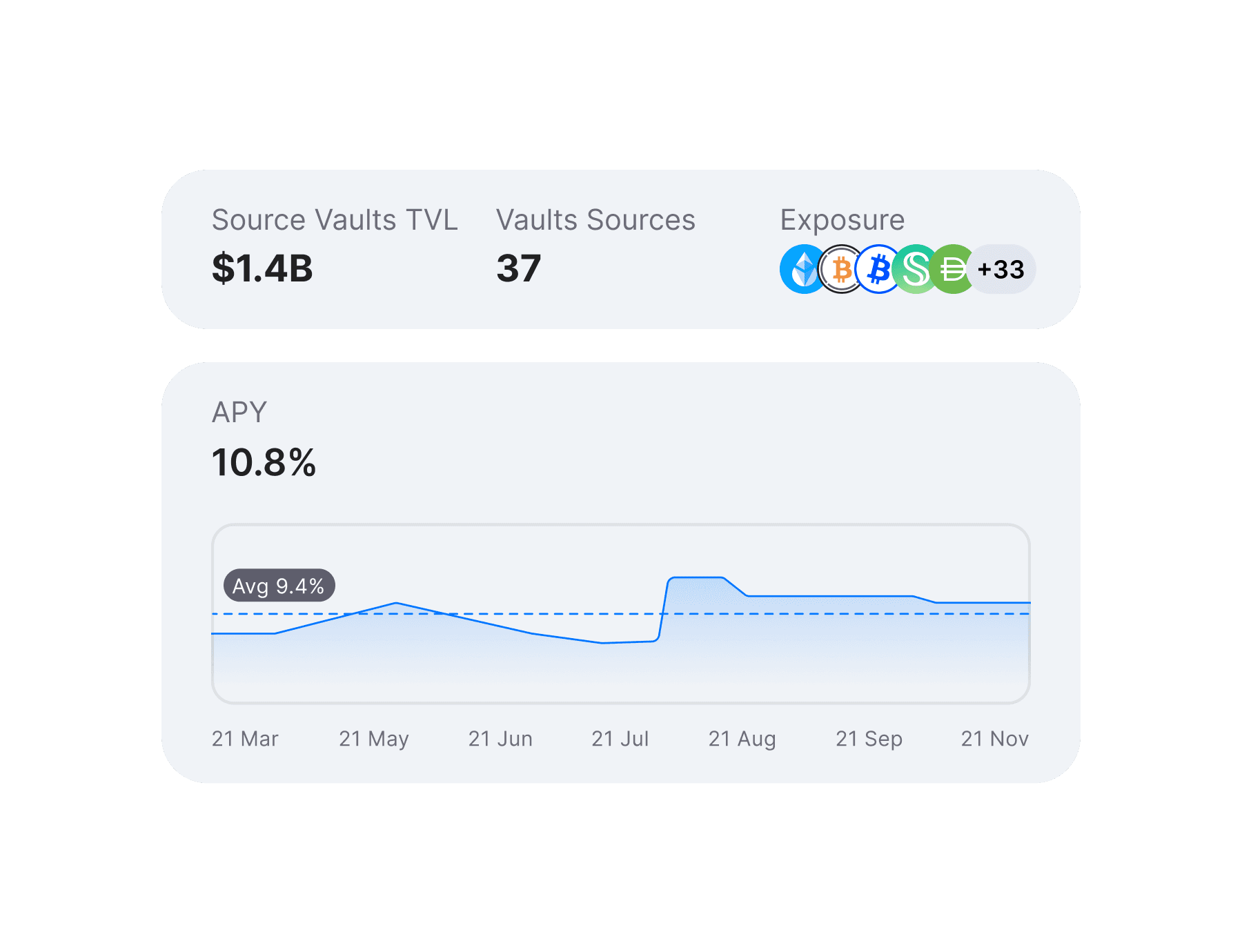

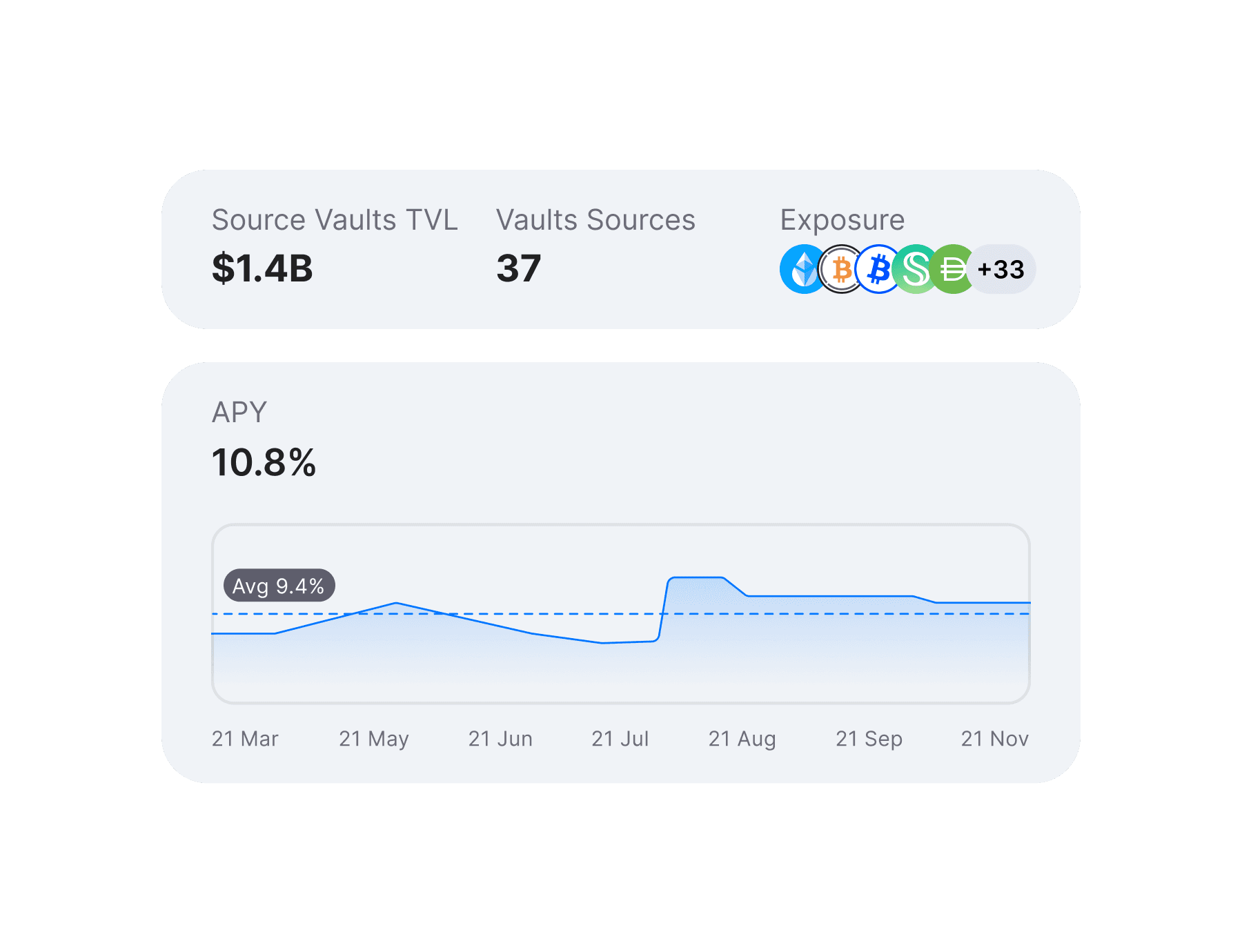

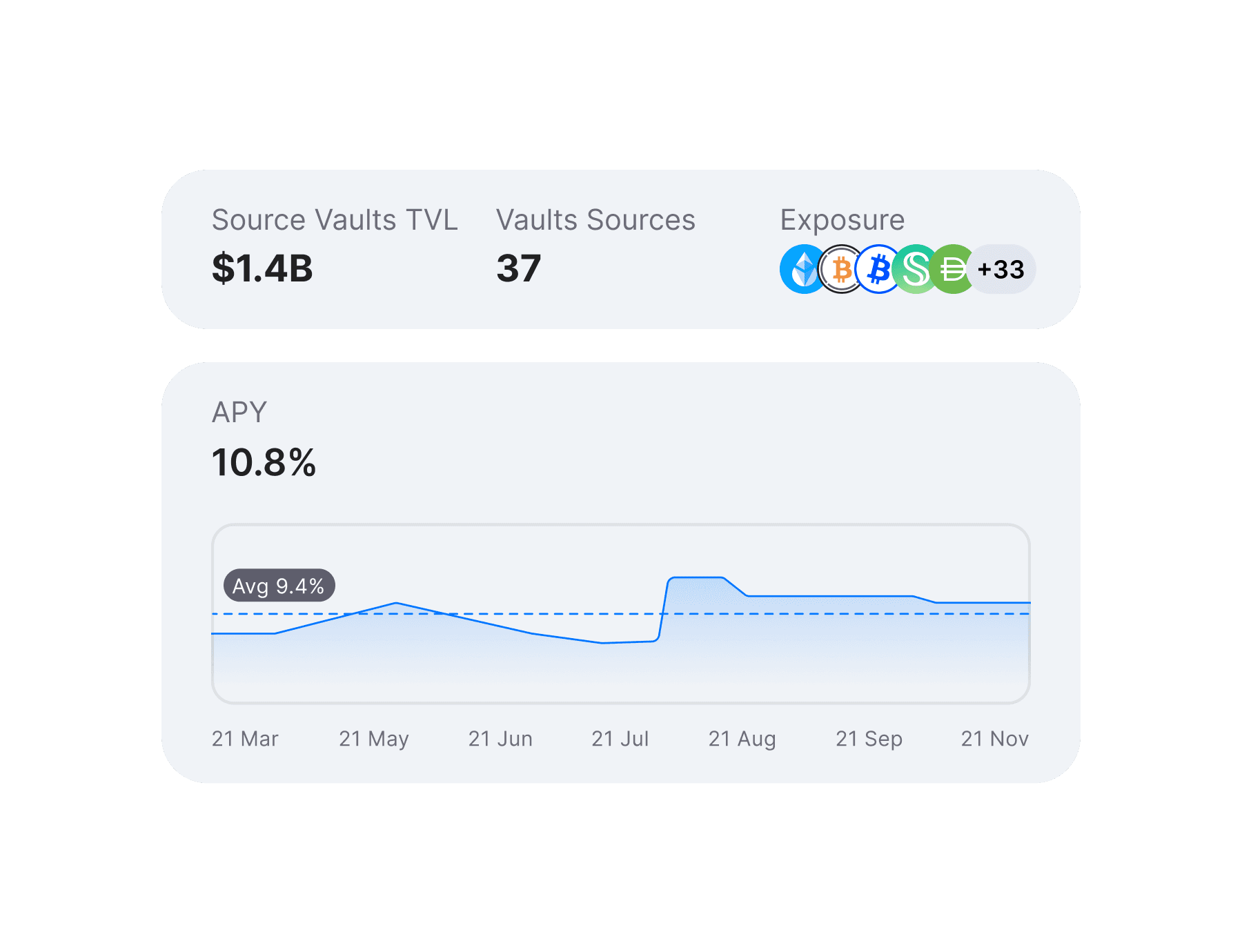

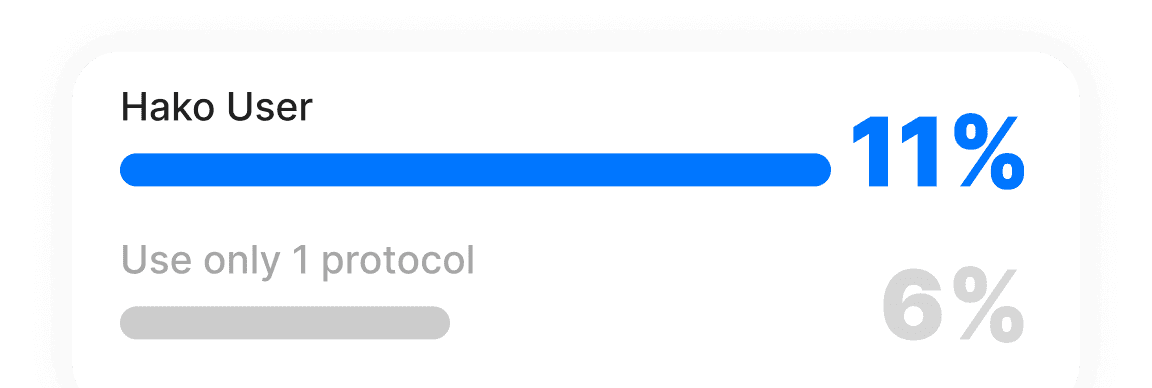

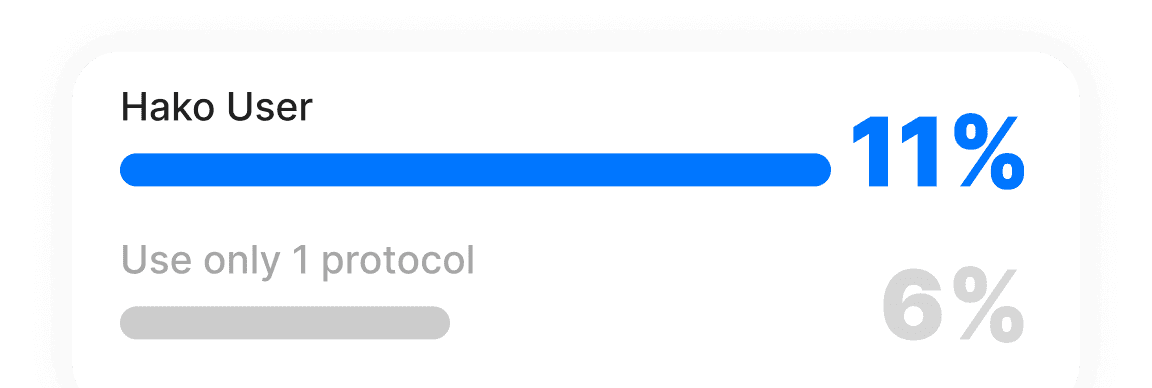

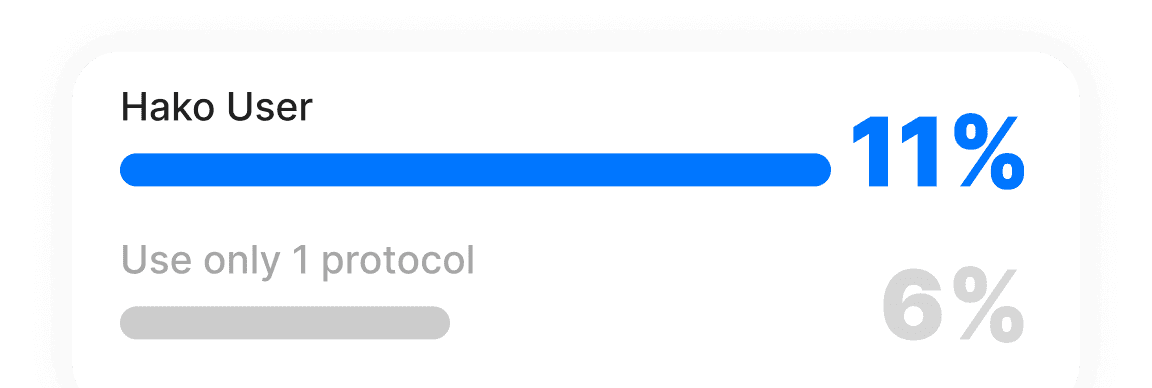

Current Yield

& Your APY Dynamics

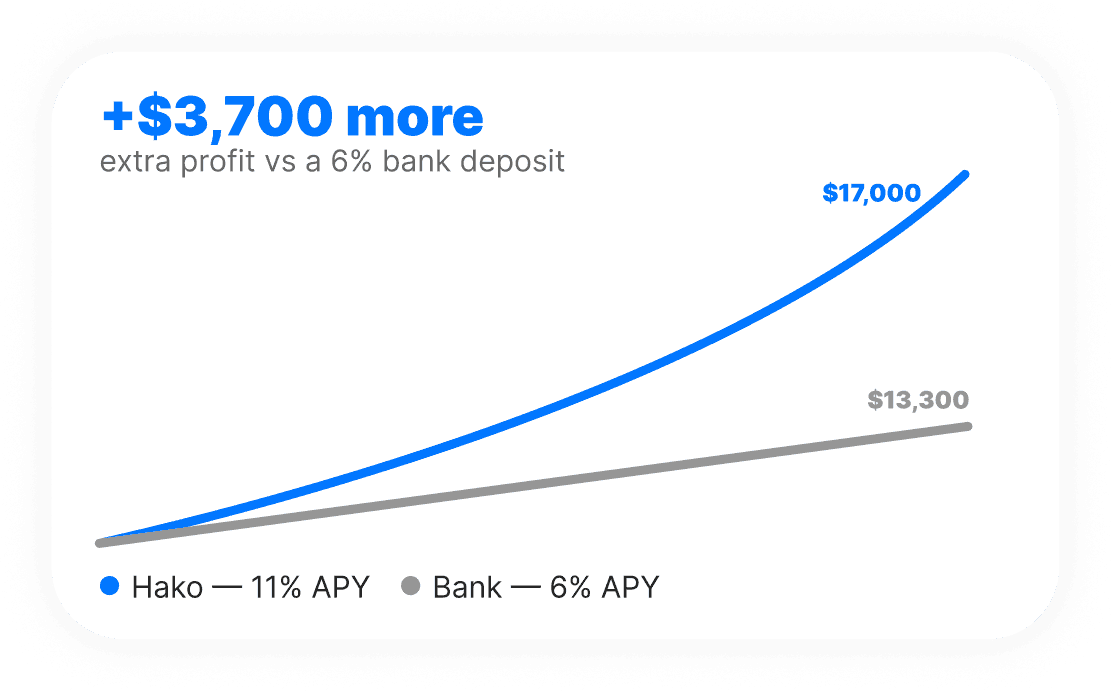

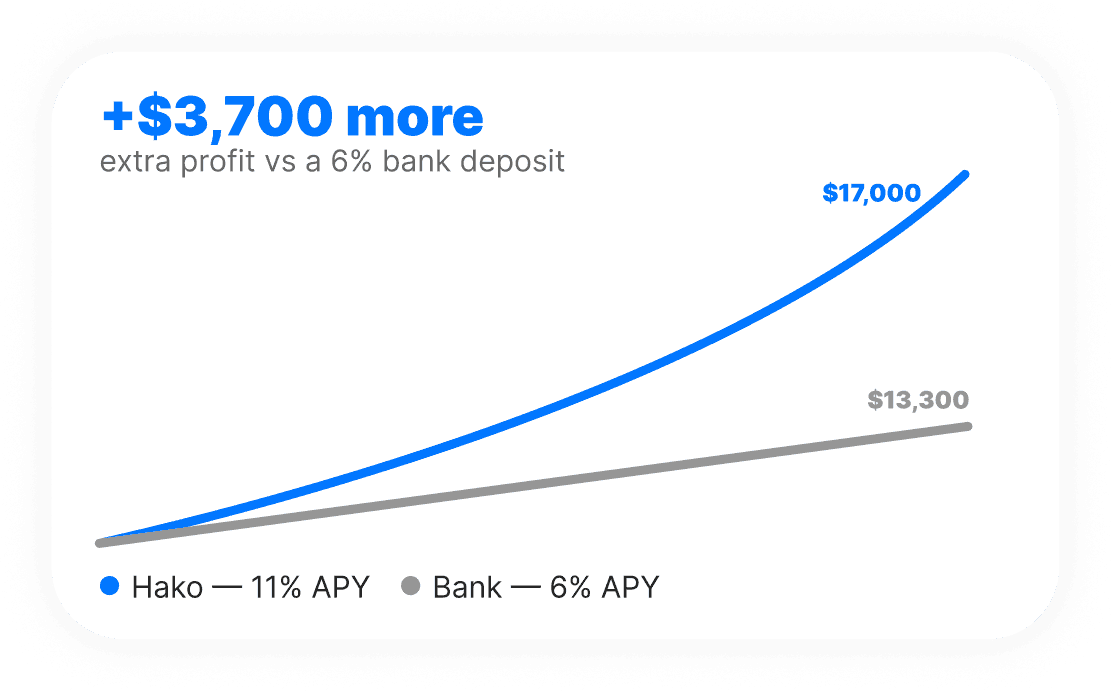

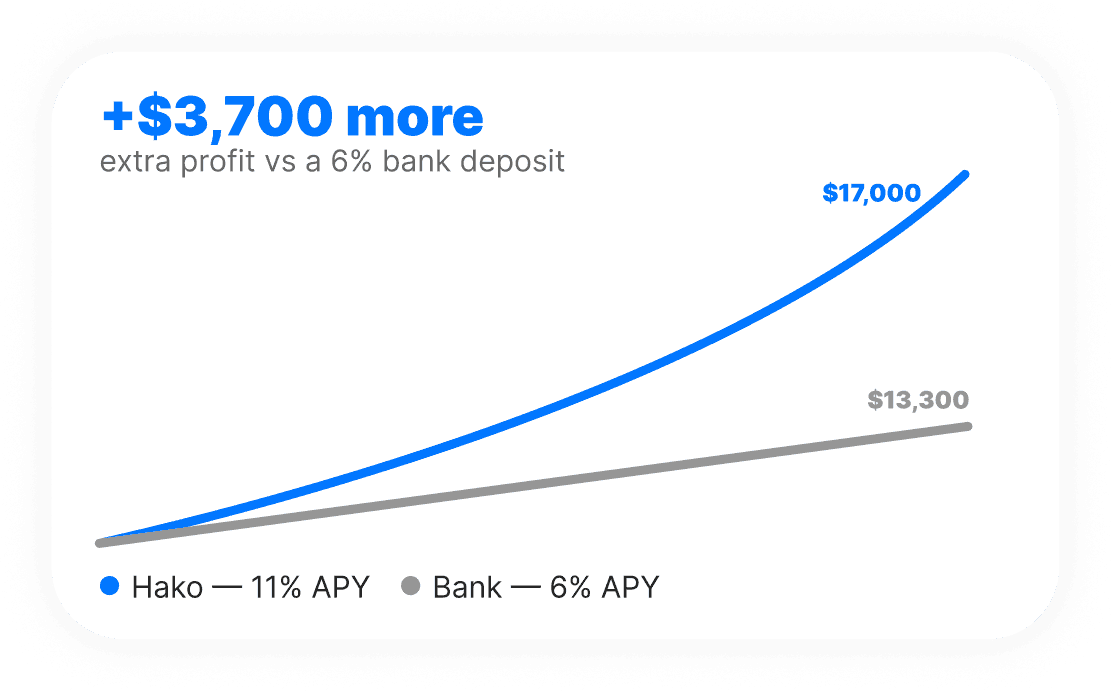

What if I invested $10,000

5 years ago?

Trusted Partners

and Verified Vault Providers

Cross-Chain Deposits

& Supported Networks

How the Strategy Operates & Allocates Your Liquidity

Current Yield

& Your APY Dynamics

What if I invested $10,000

5 years ago?

Trusted Partners

and Verified Vault Providers

Cross-Chain Deposits

& Supported Networks

How the Strategy Operates & Allocates Your Liquidity

Current Yield

& Your APY Dynamics

What if I invested $10,000

5 years ago?

FAQ

FAQ

FAQ

Is Hako Safe?

Hako selects only reputable, security-audited platforms with proven track records. Your funds are strategically allocated across multiple sources to reduce exposure to any single point of failure. Our monitoring system operates 24/7, watching for irregular activity - if potential threats are identified, all user funds are automatically withdrawn from affected protocols. Our high-performance infrastructure is designed to react faster than competitors, giving your assets priority during emergency withdrawals.

Why are the returns higher than on most other DeFi platforms?

Is there a lock-up period? How long do withdrawals take?

Which tokens and networks are supported?

Have another question?

Is Hako Safe?

Hako selects only reputable, security-audited platforms with proven track records. Your funds are strategically allocated across multiple sources to reduce exposure to any single point of failure. Our monitoring system operates 24/7, watching for irregular activity - if potential threats are identified, all user funds are automatically withdrawn from affected protocols. Our high-performance infrastructure is designed to react faster than competitors, giving your assets priority during emergency withdrawals.

Why are the returns higher than on most other DeFi platforms?

Is there a lock-up period? How long do withdrawals take?

Which tokens and networks are supported?

Have another question?

Join

Join

Join

our waitlist

our waitlist

our waitlist

Get early access to Hako and start earning automatically

© 2026 Hako